Chidubem Ogbuefi, CEO and founder of CoinCircuit, a Nigerian crypto payments startup, carries more money in crypto than he does in cash.

For him, paying with digital assets is often easier than converting to naira, waiting for a bank transfer, or processing a point of sale (PoS) withdrawal.

However, the “convenience of cryptocurrencies” is not reflected in real-world use cases.

When you ask for payment in cryptocurrencies at any store, restaurant or retail outlet in Lagos, the answer is usually the same. “No.” It irritated him.

“That friction is what drove me to build CoinCircuit,” Ogbuefi said. “It’s not because people don’t have cryptocurrencies, it’s because companies don’t want to deal with them.”

CoinCircuit, launched in December 2025, is a Nigerian startup that builds a payment infrastructure that allows companies and individuals to accept cryptocurrency payments without having to become a cryptocurrency business themselves.

This product sits between customers who want to pay with digital assets and merchants who want to receive naira or stablecoins without worrying about wallets, volatility, or compliance.

Ogbuefi explains that if the Nigerian payments giant focuses entirely on digital assets, this will be with products like Paystack. Paystack allows businesses to accept payments from customers in a variety of local currencies.

Get the best African tech newsletters in your inbox

Own cryptocurrencies and live with fiat currencies

Ogbuefi’s habit of using cryptocurrencies is unusual in Nigeria, where the fiat currency, the Naira, still dominates daily transactions.

He doesn’t dispute that reality. He argues that the use of cryptocurrencies in Nigeria is often misunderstood.

There is already a large amount of cryptocurrency activity, but it is rarely seen at supermarket checkouts or restaurant counters.

Payments can be made privately, peer-to-peer, or outside of a formal sales environment. If customers want to use cryptocurrencies in public, there is a lack of infrastructure.

“Often people walk into a store and ask if they can pay with cryptocurrencies,” Ogbuefi said. “If the answer is no, they leave. So do I.”

From his perspective, the problem isn’t demand. It’s the design.

Most existing cryptocurrency payment tools either exclude Nigeria entirely or assume that sellers want to store digital assets themselves. Global platforms such as CoinPayments and Binance Pay often do not support African countries or limit billing in local currencies.

“You cannot create a bill in Naira or Ghanaian Cedi,” he said. “So we wanted to solve it all in one product.”

How CoinCircuit works without forcing cryptocurrencies on sellers

CoinCircuit’s design begins with a compliance-first approach.

When onboarding, users identify themselves as individuals (such as solopreneurs, freelancers, content creators, etc.) or as registered sellers or businesses.

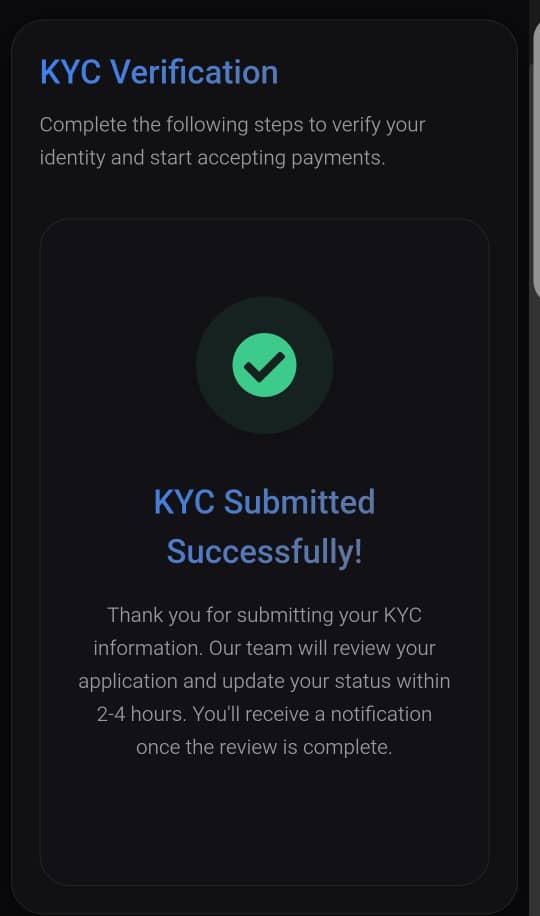

Business users must provide a Corporate Affairs Commission (CAC) document or equivalent regulatory filing. Individuals provide identification. All users complete a Know Your Customer (KYC) check to enable monitoring of transactions.

Once approved, users connect two things: a local fiat bank account and, optionally, a cryptocurrency wallet. CoinCircuit then becomes a layer between customers and merchants, converting one payment configuration to another.

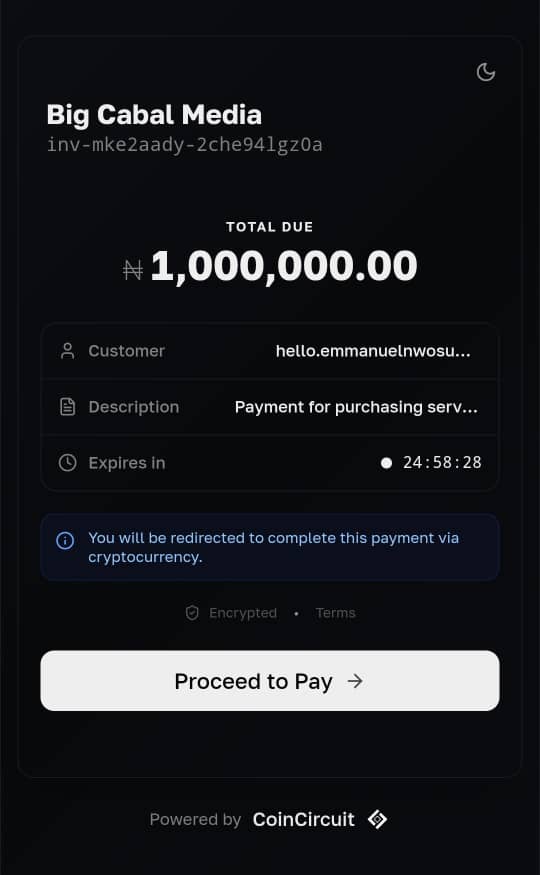

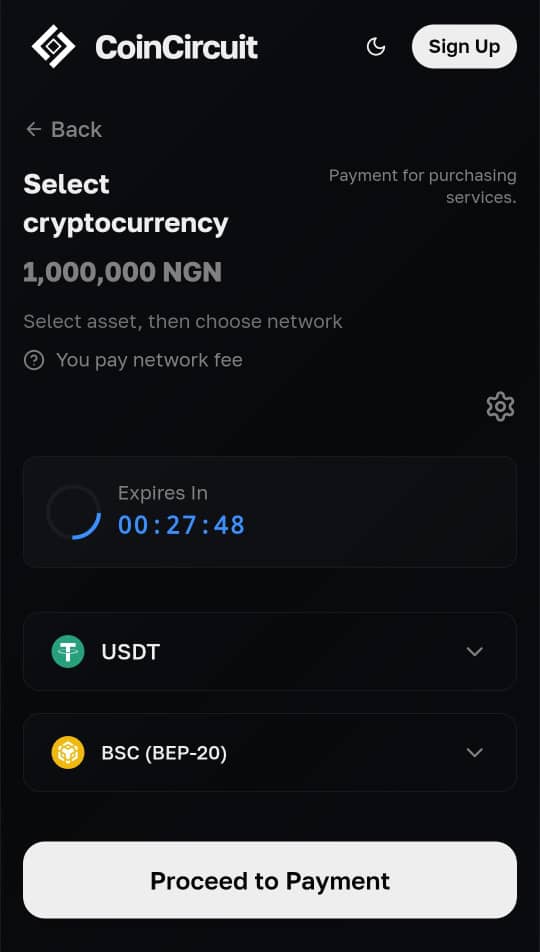

Merchants can create payment pages for use in-store or online. This page is branded with your company name and logo and can be accessed through a link or a printed quick response (QR) code. When a customer scans the code, they are taken to a checkout page where they enter the amount they want to pay.

What matters is how you estimate the amount. Sellers can choose to quote prices in Naira or USD. If the page is set to naira, customers will see naira. If set to dollars, customers will see dollars. CoinCircuit takes care of everything else.

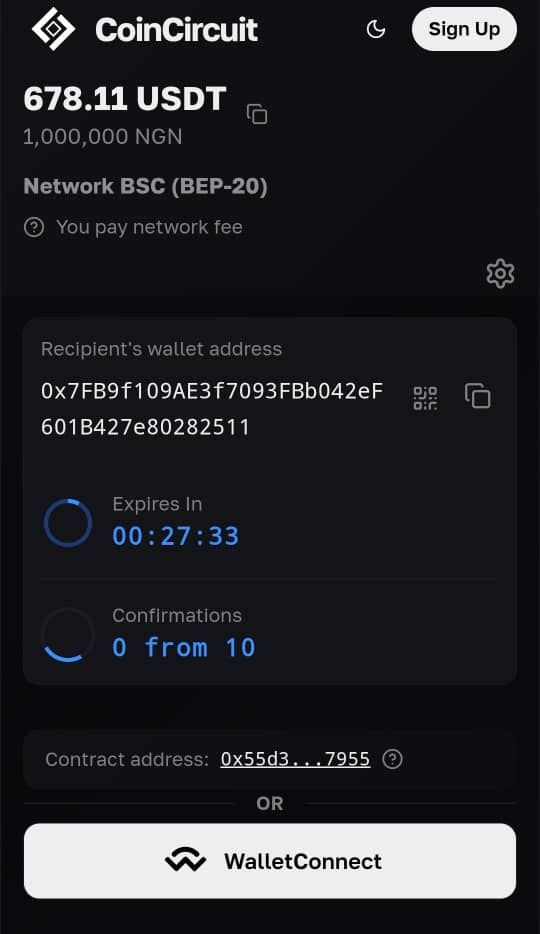

In collaboration with service providers, the startup enables real-time payments. When customers pay using cryptocurrencies or stablecoins, merchants can receive naira directly into their bank accounts or stablecoins such as Tether (USDT) in their wallets, depending on their preference.

“The logic behind this is that you quote in a currency that the customer understands and you receive a currency that you understand,” Ogbuefi said. “We are adding currencies such as the Ghanaian Cedi, Kenyan Shilling, and South African Rand to help merchants expand payment collection to a wider market.”

Beyond local and foreign currency payments, CoinCircuit supports payments in a variety of cryptocurrencies and stablecoins, including Ether (ETH), Solana (SOL), Tron (TRX), Binance Coin (BNB), USD Coin (USDC), and Tether (USDT).

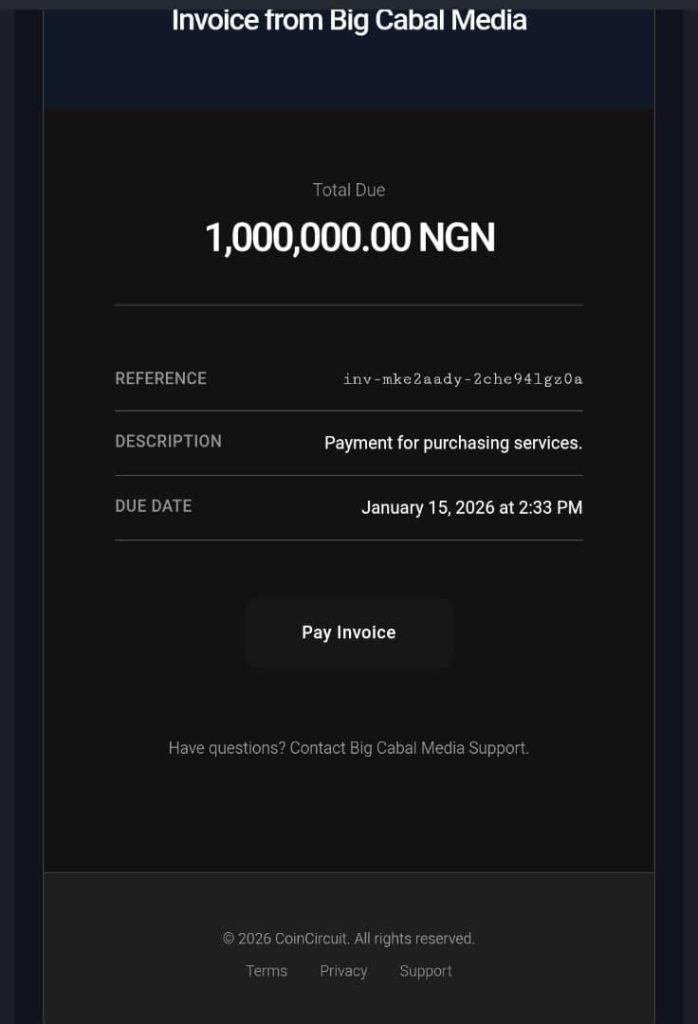

CoinCircuit sellers and creators can also create and send invoices to their customers, who can choose to pay in crypto or fiat. Image source: TechCabal.

These payments are performed on multiple blockchain networks, including Ethereum, Binance Chain, Solana, and Tron, and transaction fees are typically less than $1.

Ogbuefi said the startup plans to expand support for additional crypto assets and networks over time to adapt its product to different market payment preferences.

The flexibility of this product is a win-win. Crypto-native sellers who prefer to hold digital assets can quote their customers in naira or dollars and still receive cryptocurrencies or stablecoins.

Merchants can accept payments from customers for cryptocurrency payments and can only receive local currency.

Ogbufi said CoinCircuit does not hold customer funds. Once payment is made, crypto assets are automatically exchanged through a crypto financial service provider that provides liquidity and regulatory cover. While service providers make money from currency spreads, CoinCircuit charges a 1% take rate from customer trades.

For example, if a customer completes a $10 transaction, CoinCircuit charges a $0.1 fee.

Ogbuefi said this structure allows CoinCircuit to operate without touching deposits while offering instant payments, which he believes are essential features for trust.

“Business owners shouldn’t wait to get funding,” he says. “When customers pay with cryptocurrencies, they receive their money immediately.”

This immediacy is important in a market where late or failed payments can have a significant impact on customer skepticism and mistrust.

Get the best African tech newsletters in your inbox

Lean construction, early construction

CoinCircuit was founded in 2025 with $2,000 of the founder’s personal savings. Ogbuefi, who began his technical journey as a software and blockchain engineer, leads the company as the sole founder and technology CEO. The startup runs a lean team of five, including an engineer and a sole marketer.

Ogbuefi said CoinCircuit’s operating costs remain low, hovering between $100 and $200 per month. Ogbuefi said that although it is still in its early stages, he is currently developing the product at his own expense and has not yet made any money from the business.

Under the hood, CoinCircuit runs on an event-driven architecture designed to handle multiple currencies and blockchains simultaneously. Temporary payment addresses are generated for each transaction and expire after use. This mirrors how traditional payment sessions time out.

We also operate CoinCircuit AI, an agent chatbot built into merchant dashboards. Sellers can ask questions about transaction volume, customer behavior, or business performance and receive answers about the health of their business.

“We used ChatGPT to build an AI agent,” says Ogbuefi. “We didn’t have to build our own models. We built a list of tools and gave (ChatGPT) access to everything we could use to train our models, including access to web search functionality. Other than development costs, there’s no cost (to run CoinCircuit) because we just give existing models the ability to access tools and workflows.”

This approach reflects the company’s broader philosophy of building targetedly, avoiding unnecessary infrastructure, and spending only where it directly improves the product.

“I didn’t want to hold cryptocurrencies”

CoinCircuit says it has processed more than £12 million ($8,500) in transactions since its founding, primarily driven by retail businesses, clothing brands, restaurants, hotels, fast food outlets, and payments and transfer businesses.

Most were introduced through Mr. Ogbuefi’s personal connections and other sellers he pitched and persuaded to adopt the product.

Henry Paris, creative director of Lagos-based streetwear brand Vanityiisland Atelier, is one of them. For Paris, CoinCircuit solved a problem he had been avoiding. Customers (mostly young men) continued to request payment in cryptocurrencies. He kept saying no.

“I don’t do cryptocurrencies,” Paris said. “At that point, I didn’t want to keep the crypto and I wasn’t going to worry about selling it.”

After speaking with Ogbuefi, Paris agreed to try CoinCircuit. Setup took a few minutes. He printed a QR code and placed it in the store.

“Every time they pay in cryptocurrency, the cryptocurrency is transferred to my bank account in Naira,” he said. “That’s what surprised me.”

Paris now regularly uses CoinCircuit for in-store payments. Customers scan a QR code, pay with cryptocurrencies or stablecoins, and receive Naira directly into their local bank account. This system eliminates the need to manage wallets, manage price fluctuations, or go through cryptocurrency exchanges to convert your cryptocurrencies back into naira.

Besides convenience, Paris says an unexpected benefit of using CoinCircuit is pricing.

“When people pay in cryptocurrencies, I usually get a little bit more than the retail price,” Paris said, pointing to the exchange spread when customers convert naira prices to dollar-pegged stablecoins like USDT. “I don’t even care about the bill because I always get more.”

However, Paris has a clear eye on CoinCircuit’s role for merchants. While this solves some peripheral issues, retailers with informal businesses may still struggle to understand its true benefits, he says.

“I can’t say it’s mission critical,” he said. “Previously, my business operated on cash, transfers, and PoS. But this is nice to have, especially for crypto-natives who want to pay or sellers who don’t want the stress.”

If a product like CoinCircuit can achieve scale, it could make spending on cryptocurrencies easier for locals who prefer to carry their digital assets with them. It also gives unsophisticated managers and mid-sized companies a way to tap into a younger demographic of crypto users without exposing them to crypto-related risks.

Buildings with large existing companies nearby

There are already very few crypto payment gateways in Nigeria. Ogbuefi said that when he tried these products, he found them lacking in two areas: product value and ease of use.

“They didn’t give me what I wanted,” he said. “We wanted something simple that even people who don’t understand cryptocurrencies could set up themselves.”

This focus influences how Ogbuefi and his small team build CoinCircuit. It’s about hiding the complexity of the UX of using cryptocurrencies and making it simple and intuitive enough for even less sophisticated business owners to get started.

Ogbuefi is also acutely aware of the threats to his business. Several Nigerian fintech companies operate fiat payment gateways such as Paystack. Paystack is owned by Stripe, a global payments company that reintroduced stablecoin payments in 2024. On a related note, the co-founder theorized that it wouldn’t be out of place for the payments giant to touch on digital currencies.

When asked if Paystack, and by extension Stripe, could ultimately threaten CoinCircuit by enabling crypto payments, Ogbuefi remains pragmatic. CoinCircuit’s main market is Nigeria, where at least 25 million people use or hold cryptocurrencies.

“The chances of that happening are very low because of the regulator (Central Bank of Nigeria),” he said. “But even if they (Paystack) did, there would still be business for CoinCircuit. We are focused on cryptocurrencies, and we also do things that might not make sense for generalists.”

CoinCircuit is not trying to replace fiat payments or convert merchants to crypto believers. This simply adds one more rail, so merchants no longer have to say no when a customer asks to pay in cryptocurrency.