Nigeria’s power sector is consuming public funds at an accelerating rate, forcing the government to spend hundreds of billions of naira in subsidies to maintain power supply, even though decades of reform and billions of dollars in investment have failed to deliver reliable supply.

President Bola Tinubu, who took office in May 2023 promising tough economic reforms, is caught between the political risk of rising electricity prices and the fiscal reality of an electricity market that cannot pay its own bills.

The government abolished gasoline subsidies shortly after taking office, sparking nationwide protests, but has taken a more cautious stance on setting electricity prices, wary of voter backlash ahead of the 2027 election.

Related article: 20 more companies will relinquish control of the national power grid, creating further problems for the already shackled electricity market

Subsidy costs are driven by the loss of up to 40% of electricity generation due to aging grids, weak revenue collection, and tariffs that are significantly below the actual cost of supply.

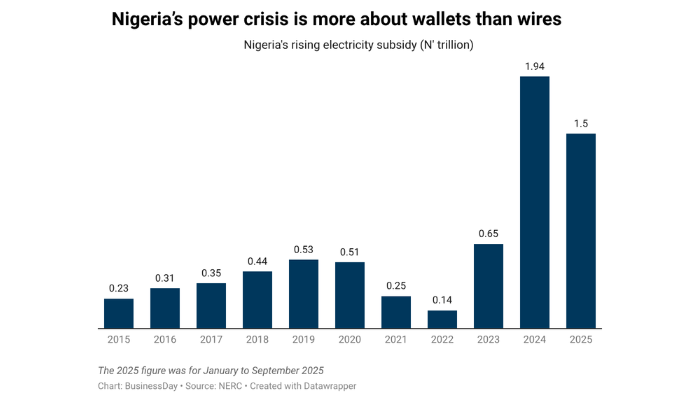

For example, the Nigerian Electricity Regulatory Commission (NERC) drained an average of N165 billion in cash per month between October 2024 and September 2025 to bridge the gap between what consumers pay and the actual cost of electricity generation.

According to NERC data, subsidy spending remained stubbornly high throughout the period.

In the fourth quarter of 2024 (Q4), the government incurred N471.69 billion as power subsidy. This figure increased to NOK 536.4 billion in the first quarter (Q1) of 2025, but decreased slightly to NOK 514.35 billion in the second quarter (Q2).

Although there was some relief in the third quarter with the subsidy decreasing to N458.75 billion, the total still represents a huge drain on the public finances.

“In the absence of cost-reflective tariffs, the government has committed to bridge the gap between cost-reflective tariffs and authorized tariffs in the form of tariff subsidies,” NERC said in its latest quarterly report.

The surge in subsidies comes as electricity distribution companies, the key link between power plants and end consumers, continue to collect far less revenue than they charge customers, creating a huge financial hole that governments are forced to fill.

As of October 2025, Nigeria’s 11 electricity distribution companies had billed customers N2.4 trillion, but had recovered only N1.9 trillion, with a 20 percent revenue disparity extending across the electricity value chain.

Industry analysts say the subsidy system has become politically toxic ahead of Nigeria’s 2027 general elections, constraining the government’s ability to implement painful but necessary reforms.

With memories of the gas subsidy repeal protests still fresh, the federal government appears reluctant to impose similar hardships on voters by raising electricity prices to reflect costs, even though the fiscal burden has become unsustainable.

“The government is caught in the middle,” said Chidi Okonkwo, an energy analyst at Lagos-based Frontier Economics. “They know that subsidies are draining the public treasury, but they fear the political backlash of eliminating them in the year before an election, so the problem will only get worse.”

Related article: Nigeria’s electricity subsidy reaches ₦1.98 trillion in 12 months despite tariff hike

Subsidy burden increases due to power generation crisis

The financial haemorrhage in Nigeria’s power sector is exacerbated by chronic underperformance at the power generation level, where installed capacity far exceeds actual output.

According to NERC’s latest data, the total installed capacity of the country’s grid-connected power plants is 13,625 megawatts, but the average capacity utilization of power plants is only 38%.

This means that almost two-thirds of Nigeria’s theoretical power generation capacity is idle or unavailable on any given day.

Olorunsogo 2 has an installed capacity of 750 megawatts, but the available capacity is only 23 megawatts, with an occupancy rate of only 3%. Although Alaoji 1 is designed for 500 megawatts, it will not contribute anything to the grid as there will be zero available capacity in December.

Sapele Steam 1 reflects this dysfunction, delivering only 23 megawatts of its 720 megawatt capacity and a catastrophic 3% utilization rate. Even among top performers, a significant amount of capacity remains unsecured. Egbin 1, the largest single power generator, will deliver 545 MW from an installed capacity of 1,320 MW, while Delta 1 will deliver 454 MW for a potential of 900 MW.

A small number of small-scale plants have demonstrated that full utilization is technically possible, further highlighting systemic deficiencies elsewhere.

Ikeja 1 will operate at 100% availability and deliver all 110 megawatts of installed capacity. Zungeru 1 similarly maximizes capacity to 700 megawatts with 100% availability. However, these success stories only highlight the scale of underperformance in most facilities. Odukpani 1 provides only 117 MW of the 625 MW installed, while Ikhovbor 1 can manage only 39 MW of its 500 MW capacity.

industrial exodus

What makes the situation particularly precarious is the accelerating withdrawal of Nigeria’s largest electricity consumer from the national grid.

Major manufacturers, telecommunications companies and commercial enterprises are investing billions of dollars in on-site power generation, installing diesel generators and increasingly installing solar power generation equipment to ensure a reliable power supply.

Dangote Group, Nestle Nigeria, Nigerian Breweries and dozens of other major companies now generate most of their own electricity needs. The telecommunications sector alone is estimated to spend more than $2 billion annually on diesel for the generators that power more than 30,000 base stations across the country.

This industrial exodus fundamentally changed the economics of Nigeria’s power sector. Originally designed to serve both high-income industrial customers and subsidized residential users through cross-subsidy, the National Grid now serves a customer base that is largely comprised of low-income households and small businesses.

“We lost our core tenant,” explains Amina Bello, a former adviser to the Ministry of Power. “Customers who were able to pay cost-reflective rates and subsidize others are gone. What remains are residential customers, many of whom are financially challenged and unable to even pay current rates.”

Also read: Gombe state joins other states to secure autonomy in electricity market regulation

Nigeria’s power sector has long been Africa’s most notorious infrastructure failure. Despite privatization in 2013 aimed at introducing efficiency and investment, the country of more than 200 million people generates less electricity than a small European country.

Peak generation rarely exceeds 5,000 megawatts and is only a fraction of the estimated demand of 30,000 megawatts.

Under the current multi-year tariff system, most electricity consumers in Nigeria pay rates that cover only a small portion of the cost of electricity generation, transmission and distribution.

NERC has approved limited rate increases for certain customer groups, including a controversial increase for Band A customers who receive at least 20 hours of daily supply, but the vast majority of consumers remain heavily subsidized.

Experts say the gap between what Nigerians pay and what they actually pay for electricity is widening due to multiple factors. Naira devaluation has increased the local currency cost of gas imports and equipment. Operating costs have increased due to inflation.

Inadequate revenue collection by distribution companies means that much of the electricity generated goes unpaid, further distorting the economy.

political conundrum

Other experts said the subsidy trap has become especially acute as Nigeria prepares for general elections in 2027.

“These subsidies are essentially welfare payments disguised as infrastructure spending,” said Aisha Mohammed, an energy analyst at the Lagos-based Center for Development Studies.

Mohammed added: “They do not improve services, they do not attract investment, they do not solve the fundamental problems of the power sector. They only postpone the day of reckoning while depleting resources that could fund education, health care and real infrastructure.”

Also read: Power issues: Will gas debt resolution finally stabilize Nigeria’s electricity market?

The timing of the subsidy increase is particularly problematic for governments already facing severe fiscal constraints.

Nigeria’s budget deficit has ballooned in recent years, forcing it to borrow more as debt servicing consumes more than 70% of federal revenue.

Eliminating gasoline subsidies in mid-2023 was intended to free up resources for development spending, but much of the savings appears to be flowing down the electricity subsidy rat hole.

International financial institutions such as the World Bank and the International Monetary Fund have repeatedly called on Nigeria to end electricity subsidies and move to cost-reflective pricing.